Key Reasons You Have To Need to Think About Spending Off Coast Today

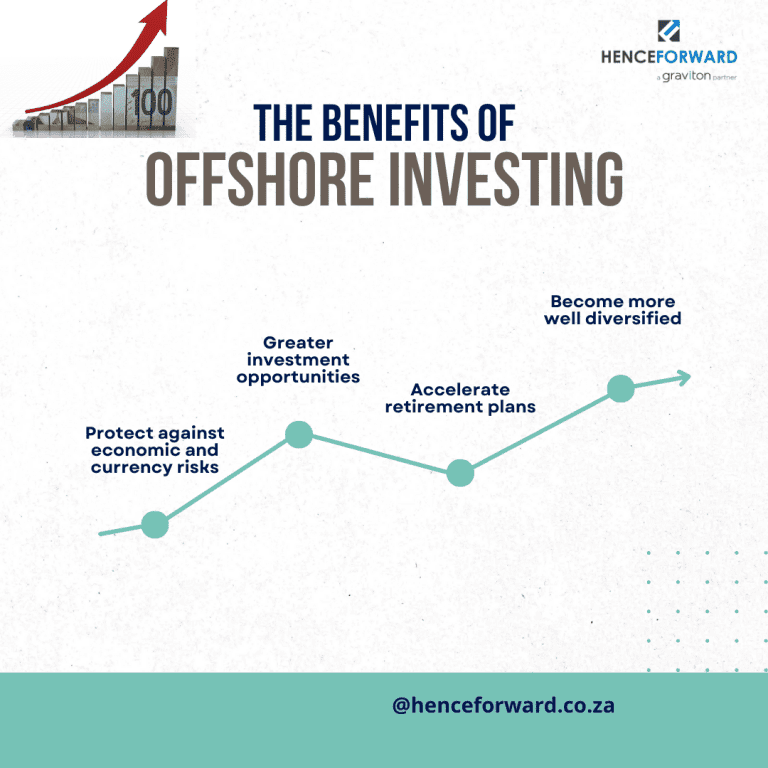

Spending offshore has actually ended up being a critical necessity for lots of individuals looking to boost their monetary safety and security. It offers diversification, prospective tax obligation advantages, and accessibility to emerging markets. Additionally, offshore financial investments can act as a safeguard versus regional economic difficulties and currency dangers. As even more capitalists acknowledge these benefits, the concern arises: what certain benefits can offshore financial investments supply in today's fluctuating market?

Diversity of Investment Portfolio

Diversification of an investment portfolio is vital for reducing risk and enhancing potential returns. Investors typically seek to spread their capital across numerous possession courses, consisting of stocks, bonds, realty, and commodities, to minimize exposure to any kind of single market occasion (Investing Off Shore). By incorporating overseas financial investments, individuals can use global markets and chances that might not be readily offered locally. This geographical diversity assists to secure versus neighborhood economic declines and money fluctuations, giving a barrier for general profile stability.Additionally, expanding financial investments offshore can introduce exposure to emerging markets, which may experience higher growth prices compared to created economic situations. Capitalists can benefit from different economic cycles, thus boosting their chances of accomplishing regular returns. Eventually, a well-diversified portfolio, inclusive of overseas assets, not only improves potential returns but likewise plays an important role in risk administration, making it possible for capitalists to browse the intricacies of the global financial landscape successfully

Tax Obligation Benefits and Incentives

Offshore investments can additionally supply significant tax obligation advantages and motivations that enhance their allure. Many countries provide beneficial tax obligation regimes for foreign financiers, including lowered tax prices on resources gains, income, and inheritance. These motivations can result in considerable financial savings contrasted to domestic tax obligation obligations. For circumstances, particular jurisdictions permit tax deferral on income until it is repatriated, enabling financiers to grow their properties without instant tax implications.Additionally, some overseas financial facilities give tax exceptions for certain sorts of earnings, such as rewards or interest, additional enhancing the appearance of these investments. Businesses that develop procedures in low-tax jurisdictions may additionally gain from tax obligation credit histories and reductions that can substantially reduce their overall tax obligation problem. Subsequently, wise investors acknowledge that understanding and leveraging these tax advantages can enhance their economic strategies and enhance their total returns on investment.

Access to Emerging Markets

Protection Against Economic Instability

While financial instability can pose significant threats, individuals and organizations commonly seek techniques that safeguard their investments. Spending offshore gives a viable remedy, given that it enables for diversification beyond residential markets. By alloting funds in stable international economic climates, investors can mitigate the effect of neighborhood slumps, currency variations, and geopolitical uncertainties.Additionally, overseas investments frequently gain from desirable regulative atmospheres, which can boost economic resilience. This geographical diversity aids to insulate profiles from local financial shocks, allowing financiers to spread their danger throughout various property classes and regions.Furthermore, spending in countries with stronger financial fundamentals can offer far better growth prospects throughout rough times. Ultimately, the defense against financial instability through overseas investment strategies you can check here acts as an important component for guarding riches and ensuring lasting financial safety and security. Subsequently, organizations and people are progressively identifying the significance of this strategy in today's unforeseeable financial landscape.

Improved Privacy and Property Safety And Security

Personal privacy and property security are paramount concerns for people looking for to secure their wealth in a significantly interconnected world. Offshore investments present a practical solution, offering enhanced confidentiality and robust asset defense devices. Lots of jurisdictions offer legal frameworks that focus on personal privacy, enabling financiers to safeguard their economic details from public examination and potential legal challenges.By developing accounts or entities in these places, individuals can cover their identification and reduce exposure to dangers related to residential laws. Additionally, overseas structures typically consist of protective functions such as trusts and restricted responsibility companies, which can protect properties from creditors and lawsuits.In an era where economic information breaches and identity theft are rampant, the allure of boosted privacy and possession safety via overseas investing remains to expand. As individuals navigate the intricacies of wide range management, the critical use offshore resources can substantially reinforce their financial defenses.

Regularly Asked Concerns

What Are the Risks Associated With Offshore Spending?

The threats of overseas investing include governing difficulties, currency changes, political instability, and potential absence of openness. Capitalists need to carefully review these variables to mitigate potential losses and assurance compliance with global legislations.

How Do I Select the Right Offshore Investment Area?

Choosing the ideal Learn More Here offshore financial investment location requires examining elements such as political security, tax policies, economic conditions, and ease of access. Researching these elements aids investors straighten their objectives with suitable territories for optimal returns and protection.

Can I Spend Offshore as a Newbie?

Spending offshore as a beginner is possible with research study and assistance. Investing Off Shore. People can start tiny, seek trusted advisors, and concentrate on available markets, guaranteeing they comprehend laws and threats connected with worldwide financial investments before proceeding

What Are the Legal Demands for Offshore Investments?

The legal demands for overseas investments vary by territory. Individuals normally require to provide identification, total essential forms, and abide by tax obligation guidelines, guaranteeing adherence to both local and international legislations regulating foreign financial investments.

How Do Currency Variations Affect Offshore Investments?

Currency fluctuations significantly impact offshore investments, modifying prospective returns and threat degrees. Investors need to consider currency exchange rate, as they can affect the value of profits and possessions when converting back to their regional money. Offshore financial investments can also give considerable tax obligation advantages and motivations that improve their appeal. Specific territories allow tax deferral on income till it is repatriated, enabling investors to grow their properties without prompt tax obligation implications.Additionally, some overseas financial centers provide tax exemptions for certain types of earnings, such as returns or passion, more raising the attractiveness of these investments. By assigning funds in stable international economic situations, capitalists can minimize the influence of regional downturns, currency variations, and geopolitical uncertainties.Additionally, offshore financial investments often benefit from beneficial regulatory settings, which can enhance economic resilience. In enhancement, offshore structures typically include protective features such as trusts and limited responsibility companies, which can shield properties from lenders and lawsuits.In an era where monetary data breaches and identification theft are widespread, the charm of enhanced personal privacy and property safety through offshore investing proceeds to grow. Picking the best overseas investment area needs reviewing factors such as political stability, tax policies, financial conditions, and availability.